Smart Insider

Although the trading activity of company directors (insiders) can offer valuable clues related to future share performance, investors are unable to monitor all the relevant trades. Identifying 'Smart Insiders' through specialist desktops or quantitative feeds enables our clients to generate alpha.

GET IN TOUCHYour browser does not support AMP video.

Our Data Analytics

Insider Transactions

The trading activity of company directors (insiders) can offer valuable

clues to future share performance although most trades offer no insight

at all.

To profit from insider trades investors need to screen out the ‘noise’ and

focus on the most relevant trades. Identifying trades which depart from

normal trading patterns and reveal a genuine conviction by insiders is

our focus. Those trades are rare and cannot be identified from source

data alone.

Our specialist service enables clients to generate alpha from timely

delivery and analysis of trades and related factors. Backed by extensive

historic research, our data ensures the truly indicative trades are

brought to the attention of our clients in a timely manner with added

context.

Share Buybacks

Our Company buyback data tracks and analyses the amount and value of

shares bought back by listed companies (Issuers). Covering every market

where share repurchases are reported, our global offering also includes

‘Buyback Announcements’ which detail the Issuers stated intentions

before buybacks are executed.

By comparing each company’s stated intentions with their executed

trades, we are able to establish patterns to help predict likely trading

decisions ahead.

Our reports and alerts cut through the statistical noise to provide clients

with concise, timely corporate share repurchase data tailored to their

stock universe.

Director Insights

We monitor reported changes in company boardrooms as they occur,

giving clients concise information on movements in Boardroom

personnel. Including exact Job Titles, biographies, appointment dates,

and role changes our data gives a clear profile of each Corporate Board

and the changes within it.

Director biographies, salaries and the monetary value of their holdings

ensures clients can establish the most influential members of a Corporate

Board and track important changes in the stocks that matter most to

them

US Politicians Data

Reporting rules in the US require Congressmen and Senators to publish details of their trades in company shares globally. The data shows which politicians have a vested interest in certain stocks and when they acquired it. This helps clients see who owns the stocks of interest to them, and see a list of the stocks each individual Politician owns.

Show MoreOur Clientele

- Analysts and Fund Managers seeking to incorporate Insider insight signals into their investment process

- Buyside and Sellside analysts looking for market sentiment data

- Quants looking to enhance systematic strategies with alternative data sources

- ESG specialists seeking aspects of corporate governance

PEOPLE

Head of Research

Quantitative Analyst

Quantitative Research Analyst

Quantitative Strategist

Senior Analyst

INSTITUTIONS

Hedge Funds

Family Offices

Institutional Portfolio Managers

Institutional Investors

Asset Managers

Latest Insights

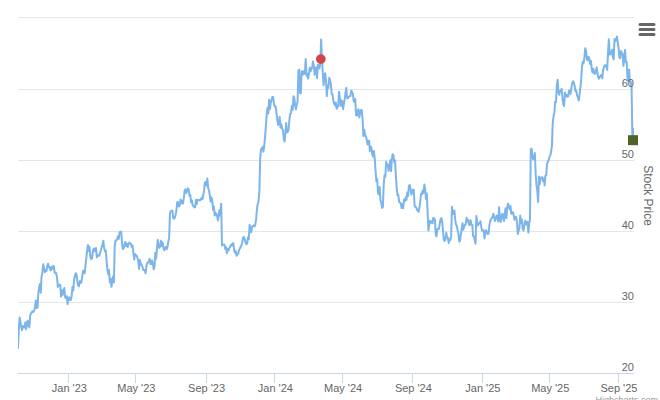

$WOR.US Ranked Positive On Sep 29th, 2025

Worthington Enterprises Inc (WOR US, +1, 29-Sep-25) Michael Endres (Lead Independent Director since 1999) bought $529,000 worth...

Read More »$MRVL.US Ranked Positive On Sep 26th, 2025

Marvell Technology Inc (MRVL US, +1, 26-Sep-25) The Chair & CEO, CFO, COO, and the President...

Read More »$TSLA.US Ranked Positive On Sep 12th, 2025

Tesla Inc (TSLA US, +1, 12-Sep-25) Elon Musk (Chief Executive Officer since Oct 2008, first joined 2004)...

Read More »Smart Insider Data

Smart Insider provides share trade analytics & advanced data inputs for multi factor stock selection models, including actionable insights for institutional investors

REQUEST TRIAL